| EQS-News: SMA Solar Technology AG / Key word(s): Annual Results SMA Group reports extraordinarily strong 2023 27.03.2024 / 06:57 CET/CEST The issuer is solely responsible for the content of this announcement. SMA Group reports extraordinarily strong 2023

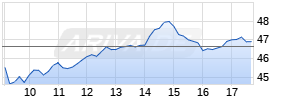

Niestetal, March 27, 2024 – SMA Solar Technology AG (SMA/ISIN: DE000A0DJ6J9/FWB: S92) has confirmed the provisional figures for 2023 as a whole and the guidance for 2024 published on February 29, 2024. In the2023 fiscal year, consolidated sales increased by 78.6% to €1,904.1 million (2022: €1,065.9 million). The gross margin was up significantly year on year at 29.4% (2022: 21.0%), driven in particular by increased profitability in the Home Solutions segment. EBITDA increased significantly from €70.0 million in the 2022 fiscal year to €311.0 million. This corresponds to an EBITDA margin of 16.3% (2022: 6.6%). This positive performance was driven both by persistently high demand for SMA products and by an improvement in production capacity utilization and the associated fixed cost degression as a result of the increased sales volume. EBIT climbed from €31.9 million in the 2022 fiscal year to €269.5 million (EBIT margin 2023: 14.2%; 2022: 3.0%). Net income more than quadrupled to €225.7 million (2022: €55.8 million), driven by the positive operating performance. Inverter output sold in 2023 as a whole was 20.5 GW (2022: 12.2 GW). At €283.3 million, net cash was significantly above the previous year‘s level (December 31, 2022: €220.1 million). The equity ratio rose to 42.3% (December 31, 2022: 41.8%). Extraordinary sales and earnings in all segments Sales in the Home Solutions segment rose by 73.2% to €580.2 million (2022: €335.0 million). The share of total sales thus amounted to 30.5% (2022: 31.4%). The EMEA region continued to account for the highest share of sales at 96.9% (2022: 86.7%). A share of 2.0% was attributable to the Americas region (2022: 8.3%) and 1.1% to the APAC region (2022: 5.0%). EBIT increased to €148.0 million (2022: €53.8 million) due to the sales growth, the associated fixed cost degression and a high-margin product mix. This corresponds to an EBIT margin of 25.5% (2022: 16.1%). The Commercial & Industrial (C&I) Solutions segment also posted a significant sales increase of 65.0% to €478.9 million (2022: €290.3 million). Its share of the SMA Group’s total sales was 25.1% (2022: 27.2%). Regionally, the EMEA region accounted for 80.8% of segment sales, the Americas region for 11.7% and the APAC region for 7.5% (2022: 79.4% EMEA, 11.5% Americas, 9.1% APAC). EBIT improved to €22.7 million (2022: –€26.0 million) with an EBIT margin of 4.7% (2022: –9.0%). The Large Scale & Project Solutions segment posted the largest sales growth of 91.8% to €845.0 million (2022: €440.6 million). Sales again increased considerably in the fourth quarter of 2023 in particular. The segment’s share of total sales was 44.4% (2022: 41.4%). 48.6% of segment sales were attributable to the Americas region (2022: 45.3%), 10.5% to the APAC region (2022: 21.5%) and 40.9% to the EMEA region (2022: 33.2%). EBIT increased significantly to €103.8 million (2022: −€13.5 million) as a result of the sales increases and thus improved production capacity utilization with associated fixed cost degression. The EBIT margin was 12.3% (2022: −3.1%). Order backlog remains at a high level At €1,705.0 million, the SMA Group’s order backlog as of December 31, 2023, remained at a high level and was much higher than the pre-pandemic level, but, as expected, lower than the order backlog at the end of the previous year (December 31, 2022: €2,077.4 million). Incoming orders declined as anticipated in the second half of the year compared with the first two quarters of 2023, as the majority of orders for 2023 in the Home Solutions and C&I Solutions segments had already been placed by the end of the first quarter. Thanks to improved delivery capacity and good production capacity utilization, the order backlog was also continuously reduced. €1,329.8 million (December 31, 2022: €1,700.7 million) was attributable to product business. Persistently strong demand was seen in the Large Scale & Project Solutions segment, with the order backlog rising to €914 million (December 31, 2022: €603 million), followed by C&I with €238 million and the Home Solutions segment with €177 million (December 31, 2022: C&I: €508 million; Home €589 million). The Managing Board has confirmed the full-year guidance from February 29, 2024, with sales of between €1,950 million and €2,220 million and EBITDA of between €220 million and €290 million. Additional information SMA published its audited Consolidated Financial Statements and the Annual Report for 2023 today and will explain the business development during a virtual press conference at 10:00 a.m. and a conference call for analysts and investors at 1:30 p.m. About SMA As a leading global specialist in photovoltaic and storage system technology, the SMA Group is setting the standards today for the decentralized and renewable energy supply of tomorrow. SMA’s portfolio contains a wide range of efficient PV and battery inverters, holistic system solutions for PV and battery-storage systems of all power classes, intelligent energy management systems and charging solutions for electric vehicles and power-to-gas applications. Digital energy services as well as extensive services up to and including operation and maintenance services for PV power plants round off SMA’s range. SMA inverters installed throughout the world within the last 20 years with a total output of approximately 132 GW help avoid the emission of more than 70 million tons of CO2 annually. SMA’s multi-award-winning technology is protected by more than 1,600 patents and utility models. Since 2008, the Group’s parent company, SMA Solar Technology AG, has been listed on the Prime Standard of the Frankfurt Stock Exchange (S92) and is listed onin the MDAX index and TecDAX index.

SMA Solar Technology AG Sonnenallee 1 34266 Niestetal Germany

Press Contact: Dagmar Buth-Parvaresh Tel. +49 561 9522-421414

Investor Relations Contact: Viona Brandt Tel. +49 175 93 93 320 Disclaimer: This press release serves only as information and does not constitute an offer or invitation to subscribe for, acquire, hold or sell any securities of SMA Solar Technology AG (the “Company”) or any present or future subsidiary of the Company (together with the Company, the “SMA Group”) nor should it form the basis of, or be relied upon in connection with, any contract to purchase or subscribe for any securities in the Company or any member of the SMA Group or commitment whatsoever. Securities may not be offered or sold in the United States of America absent registration or an exemption from registration under the U.S. Securities Act of 1933, as amended. This press release can contain future-oriented statements. Future-oriented statements are statements which do not describe facts of the past. They also include statements about our assumptions and expectations. These statements are based on plans, estimations and forecasts which the Managing Board of SMA Solar Technology AG (SMA or company) has available at this time. Future-oriented statements are therefore only valid on the day on which they are made. Future-oriented statements by nature contain risks and elements of uncertainty. Various known and unknown risks, uncertainties and other factors can lead to considerable differences between the actual results, the financial position, the development or the performance of the corporation and the estimates given here. These factors include those which SMA has discussed in published reports. These reports are available on the SMA website at www.SMA.de. The company accepts no obligation whatsoever to update these future-oriented statements or to adjust them to future events or developments.

27.03.2024 CET/CEST Dissemination of a Corporate News, transmitted by EQS News - a service of EQS Group AG. The issuer is solely responsible for the content of this announcement. The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. Archive at www.eqs-news.com |

| Language: | English |

| Company: | SMA Solar Technology AG |

| Sonnenallee 1 | |

| 34266 Niestetal | |

| Germany | |

| Phone: | +49 (0)561 / 9522 - 0 |

| Fax: | +49 (0)561 / 9522 - 100 |

| E-mail: | info@sma.de |

| Internet: | http://www.sma.de |

| ISIN: | DE000A0DJ6J9 |

| WKN: | A0DJ6J |

| Indices: | MDAX, TecDAX |

| Listed: | Regulated Market in Frankfurt (Prime Standard); Regulated Unofficial Market in Berlin, Dusseldorf, Munich, Stuttgart, Tradegate Exchange |

| EQS News ID: | 1867969 |

| End of News | EQS News Service |

| |

1867969 27.03.2024 CET/CEST