Vancouver, British Columbia and Johannesburg, South Africa--(Newsfile Corp. - April 8, 2020) - Platinum Group Metals Ltd. (TSX: PTM); (NYSE American: PLG) ("Platinum Group" "PTM" or the "Company") reports the Company's financial results for the six months ended February 29, 2020 and provides a summary of recent events and outlook.

An implementation budget and work program are now underway advancing the Company's palladium dominant Waterberg project, located on the North Limb of the Bushveld Complex in South Africa (the "Waterberg Project"). The budget and program are 100% funded by Impala Platinum Holdings Ltd. ("Implats") and are managed by Waterberg JV Resources (Pty) Limited ("Waterberg JV Co.") representing the joint venture owners, being Platinum Group, Implats, Japan Oil, Gas and Metals National Corporation ("JOGMEC"), Hanwa Co. Ltd. and Mnombo Wethu Consultants (Pty) Ltd. ("Mnombo"). The Waterberg Project is advancing while abiding by government health restrictions.

For details of the condensed consolidated interim financial statements for the six months ended February 29, 2020 (the "Financial Statements") and Management's Discussion and Analysis for the six months ended February 29, 2020, please see the Company's filings on SEDAR (www.sedar.com) or on EDGAR (www.sec.gov). Shareholders are encouraged to visit the Company's website at www.platinumgroupmetals.net. Shareholders may receive a hard copy of the complete Financial Statements from the Company free of charge upon request.

All amounts herein are reported in United States dollars unless otherwise specified. The Company holds cash in Canadian dollars, United States dollars and South African Rand. Changes in exchange rates may create variances in the cash holdings or results reported.

Recent Events

On March 31, 2020 the termination date of Implats' Purchase and Development Option (the "Purchase and Development Option") was amended, by formal agreement, from the original date of April 17, 2020 to 90 calendar days following receipt of an executed Mining Right for the Waterberg Project. In consideration, Implats is funding 100% of a new implementation budget and work program (the "Work Program"). The Work Program, to cost approximately Rand 55 million, is aimed at increasing confidence in specific areas of the Waterberg DFS while awaiting the grant of a Mining Right and Environmental Authorization. Under the Purchase and Development Option Implats may elect to increase its stake in Waterberg JV Co. from 15% to 50.01% by purchasing an additional 12.195% equity interest from JOGMEC for $34.8 million and earning a further 22.815% interest by making a firm commitment to an expenditure of $130.0 million in development work. Implats made a strategic investment of $30.0 million in November 2017 to purchase a 15% stake in the project.

On December 19, 2019 the Company closed a non-brokered private placement of 3,225,807 common shares at price of $1.24 each for gross proceeds of $4.0 million. Hosken Consolidated Investments Limited ("HCI"), an existing major shareholder of the Company, subscribed for 1,612,931 common shares through Deepkloof Limited ("Deepkloof"), a wholly owned subsidiary of HCI, increasing HCI's effective ownership percentage in the Company to approximately 31.67%.

On September 24, 2019 the Company published the results of an independent Definitive Feasibility Study for the Waterberg Project (the "Waterberg DFS"). Later, on December 5, 2019, the shareholders of Waterberg JV Co. formally approved the Waterberg DFS. The Waterberg DFS concludes that the Waterberg Project will be one of the largest and potentially lowest cash cost underground PGM mines globally. The associated technical report entitled "Independent Technical Report, Waterberg Project Definitive Feasibility Study and Mineral Resource Update, Bushveld Complex, South Africa" dated October 4, 2019 was filed on SEDAR on October 7, 2019. Key findings of the Waterberg DFS include:

- The Waterberg DFS projects a fully mechanised, shallow, decline access palladium, platinum, gold and rhodium ("4E") mine at an annual steady state production rate of 420,000 4E ounces and a 45 year mine life on current reserves. Peak project funding is estimated at $617 million.

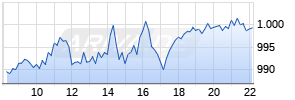

- After-tax Net Present Value ("NPV") of $982 million, at an 8% real discount rate, using spot metal prices as at September 4, 2019 (Incl. $1,546 Pd/oz) ("Spot Prices").

- After-tax NPV of $333 million, at an 8% real discount rate, using three-year trailing average metal prices up until September 4, 2019 (Incl. $1,055 Pd/oz) ("Three Year Trailing Prices").

- After-tax Internal Rate of Return ("IRR") of 20.7% at Spot Prices and 13.3% at Three Year Trailing Prices.

- On site life of mine average cash cost (inclusive of by-product credits and smelter discounts) for the spot price scenario equates to $640 per 4E ounce.

- Updated measured and indicated mineral resources1 of 242.4 million tonnes at 3.38g/t 4E for 26.4 million 4E ounces (using 2.5 g/t 4E cut-off) and the deposit remains open on strike to the north and below a depth cut-off of 1,250-meters.

- Proven and probable mineral reserves2 of 187.5 million tonnes at 3.24 g/t 4E for 19.5 million 4E ounces (using 2.5 g/t 4E cut-off), a significant increase from the Waterberg Project's 2016 Pre-Feasibility Study.

On August 21, 2019 the Company closed a public offering of securities on a bought deal basis in the United States of 8,326,957 common shares of the Company at a price of $1.25 per share for gross proceeds of approximately $10.41 million.

On August 21, 2019 the Company also completed or executed, as the case may be:

- A new credit agreement with Sprott Private Resource Lending II (Collector), LP ("Sprott") for a $20.0 million senior secured credit facility (the "2019 Sprott Facility") maturing August 21, 2021, bearing interest at 11.00% per annum and which may be extended for a further year at the option of the Company.

- A subscription by Deepkloof, on a private placement basis, for 6,940,000 common shares of the Company ("Common Shares") at a price of $1.32 per share for aggregate gross proceeds $9,160,800.

- A subscription by Liberty Metals & Mining, LLC ("LMM"), on a private placement basis, for 7,575,758 Common Shares at a price of $1.32 per share for aggregate gross proceeds of $10.0 million; and

- A payout agreement with respect to the full settlement of a $43.0 million secured loan facility due to LMM.

On July 12, 2019, Platinum Group, together with an affiliate of Anglo American Platinum Limited (''Anglo''), launched a new venture through a jointly owned company, Lion Battery Technologies Inc. (''Lion'') to accelerate the development of next generation battery technology using platinum and palladium.

Results For The Six Months Ended February 29, 2020

The Company has taken significant steps to cut costs and reduce debt during the last year. During the six months ended February 29, 2020, the Company realized a net loss of $2.55 million (February 28, 2019 - net loss of $9.46 million). General and administrative expenses during the period were $1.91 million (February 28, 2019 - $2.91 million). Losses on foreign exchange were $0.36 million (February 29, 2019 - $0.56 million), primarily due to variance in the US Dollar to Canadian Dollar exchange rate. Stock based compensation expense, a non-cash item, totalled $0.74 million (February 28, 2019 - $0.16 million). Interest costs of $2.71 million were lower in the current period (February 28, 2019 - $4.98 million) due to lower debt levels. A gain on fair value of financial instruments of $3.06 million was recognized in the current period (February 28, 2019 - $2.43 million loss) due predominantly to a decrease in the value of unexercised US$1.70 common share purchase warrants that expired on November 22, 2019. Basic and diluted loss per share for the six months ended February 29, 2020 totalled $0.04 as compared to a loss of $0.32 per share for the six months ended February 28, 2019.

Accounts receivable at February 29, 2020 totalled $0.40 million (February 28, 2019 - $0.51 million) while accounts payable and accrued liabilities amounted to $0.94 million (February 28, 2019 - $4.02 million). Accounts receivable were comprised of mainly of amounts receivable for value added taxes repayable to the Company in South Africa. Accounts payable consisted primarily of engineering and professional fees and regular trade payables.

Total expenditures on the Waterberg Project, before partner reimbursements, for the six months ended February 29, 2020 were approximately $1.70 million (February 28, 2019 - $5.13 million). At period end, $37.41 million in accumulated net costs had been capitalized to the Waterberg Project. Total expenditures on the property since inception to February 29, 2020 are approximately $72 million.

For more information on mineral properties, see Note 3 of the Financial Statements.

Outlook

The Company's key business objective is to advance the palladium dominant Waterberg Project to a development and construction decision. The Company achieved several of these key objectives during the past twelve months. The positive results of the recent Waterberg DFS provide a solid value assessment for the Waterberg Project in 2020. Engineering is proceeding on the Waterberg Project as planned.

The execution of the amended Purchase and Development Option on March 31, 2020 was a positive milestone as Implats approved 100% funding of a Rand 55 million Work Program for the Waterberg Project. Over the next few months, the Work Program will focus on project optimization, risk mitigation and housing considerations. The Work Program is currently being carried out remotely in compliance with South African stay at home orders aimed at halting the spread of the COVID-19 virus.

The Company will continue working towards its next major milestone of obtaining the Mining Right for the Waterberg Project. The expected grant of a Mining Right may be delayed from previous guidance as a result of the current South African stay at home order and possible future restrictions. Contact with government and regulatory agencies has continued to date.

Concentrate offtake negotiations with Implats are currently in process, along with other offtake possibilities being considered, subject to Implats' right to match. The current spot metal basket price per 4E ounce for the Waterberg Project is approximately 18% above the spot 4E metal basket price in the Waterberg DFS.

The long term market outlook for strong palladium demand and the potential for continued palladium supply deficits indicates a bright future for the Waterberg Project. In the near term, the COVID-19 pandemic and related measures taken by governments have created uncertainty and adverse impacts.

The Company's battery technology initiative through Lion with Anglo represents an exciting opportunity in the high-profile lithium battery research and innovation field. Recent work in the lab on Lion's innovations has been very promising and in line with our technical objectives. The investment in Lion creates a potential vertical integration with a broader industrial market development strategy to bring new technologies to market which use palladium and platinum.

The Company will follow government health directives in the months ahead. The health and safety of employees is a priority. The company plans to drive ahead with its core business objectives while reducing costs where possible in this period of market uncertainty.

As well as the discussions within this press release, the reader is encouraged to also see the Company's disclosure made under the heading "Risk Factors" in the Company's 2019 annual Form 20-F, which was also filed as the Company's AIF in Canada.

Qualified Person

R. Michael Jones, P.Eng., the Company's President, Chief Executive Officer and a shareholder of the Company, is a non-independent qualified person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and is responsible for preparing the scientific and technical information contained in this news release. He has verified the data by reviewing the detailed information of the geological and engineering staff and independent qualified person reports as well as visiting the Waterberg Project site regularly.

About Platinum Group Metals Ltd. and Waterberg Project

Platinum Group Metals Ltd. is the operator of the Waterberg Project, a large, low cost, bulk underground palladium and platinum deposit located in South Africa. The Waterberg Project was discovered by Platinum Group and is being jointly developed with Implats, JOGMEC, Mnombo and Hanwa Co. Ltd.

The Company is also invested with Anglo in a promising battery technology that uses platinum and palladium through a private battery technology company, Lion.

Platinum Group has implemented a work from home policy for both the South Africa and Canadian offices, inline with government directives. The Company is continuing with operations utilizing the Company's pre-existing remote, secure IT connectivity and video conferencing in order to continue working effectively.

On behalf of the Board of

Platinum Group Metals Ltd.

Frank R. Hallam

CFO, Corporate Secretary and Director

For further information contact:

R. Michael Jones, President

or Kris Begic, VP, Corporate Development

Platinum Group Metals Ltd., Vancouver

Tel: (604) 899-5450 / Toll Free: (866) 899-5450

www.platinumgroupmetals.net

Disclosure

The Toronto Stock Exchange and the NYSE American have not reviewed and do not accept responsibility for the accuracy or adequacy of this news release, which has been prepared by management.

The recent COVID-19 pandemic and related measures taken by government create uncertainty and have had, and may continue to have, an adverse impact on many aspects of the Company's business, including employee health, workforce productivity and availability, travel restrictions, contractor availability, supply availability, the Company's ability to maintain its controls and procedures regarding financial and disclosure matters and the availability of insurance and the costs thereof, some of which, individually or when aggregated with other impacts, may be material to the Company.

This press release contains forward-looking information within the meaning of Canadian securities laws and forward-looking statements within the meaning of U.S. securities laws (collectively "forward-looking statements"). Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, plans, postulate and similar expressions, or are those, which, by their nature, refer to future events. All statements that are not statements of historical fact are forward-looking statements. Forward-looking statements in this press release include, without limitation, statements regarding the amendment to the Purchase and Development Option and other agreements as discussed herein, potential exercise by Implats of the Purchase and Development Option, financing and mine development at the Waterberg Project and grant of the mine right application. Although the Company believes any forward-looking statements in this press release are reasonable, it can give no assurance that the expectations and assumptions in such statements will prove to be correct.

The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance and that actual results may differ materially from those in forward-looking statements as a result of various factors, including possible adverse impacts due the global outbreak of COVID-19 (as described above), the Company's inability to generate sufficient cash flow or raise sufficient additional capital to make payment on its indebtedness, and to comply with the terms of such indebtedness; additional financing requirements; the 2019 Sprott Facility is, and any new indebtedness may be, secured and the Company has pledged its shares of Platinum Group Metals (RSA) Proprietary Limited ("PTM RSA"), and PTM RSA has pledged its shares of Waterberg JV Co. to Sprott, under the 2019 Sprott Facility, which potentially could result in the loss of the Company's interest in PTM RSA and the Waterberg Project in the event of a default under the 2019 Sprott Facility or any new secured indebtedness; the Company's history of losses and negative cash flow; the Company's ability to continue as a going concern; the Company's properties may not be brought into a state of commercial production; uncertainty of estimated production, development plans and cost estimates for the Waterberg Project; discrepancies between actual and estimated mineral reserves and mineral resources, between actual and estimated development and operating costs, between actual and estimated metallurgical recoveries and between estimated and actual production; fluctuations in the relative values of the U.S. Dollar, the Rand and the Canadian Dollar; volatility in metals prices; Implats may not exercise the Purchase and Development Option; the Company may become subject to the U.S. Investment Company Act; the failure of the Company or the other shareholders to fund their pro rata share of funding obligations for the Waterberg Project; any disputes or disagreements with the other shareholders of Waterberg JV Co. or Mnombo; the ability of the Company to retain its key management employees and skilled and experienced personnel; conflicts of interest; litigation or other administrative proceedings brought against the Company; actual or alleged breaches of governance processes or instances of fraud, bribery or corruption; exploration, development and mining risks and the inherently dangerous nature of the mining industry, and the risk of inadequate insurance or inability to obtain insurance to cover these risks and other risks and uncertainties; property and mineral title risks including defective title to mineral claims or property; changes in national and local government legislation, taxation, controls, regulations and political or economic developments in Canada and South Africa; equipment shortages and the ability of the Company to acquire necessary access rights and infrastructure for its mineral properties; environmental regulations and the ability to obtain and maintain necessary permits, including environmental authorizations and water use licences; extreme competition in the mineral exploration industry; delays in obtaining, or a failure to obtain, permits necessary for current or future operations or failures to comply with the terms of such permits; risks of doing business in South Africa, including but not limited to, labour, economic and political instability and potential changes to and failures to comply with legislation; the Company's common shares may be delisted from the NYSE American or the Toronto Stock Exchange if it cannot maintain compliance with the applicable listing requirements; and other risk factors described in the Company's most recent Form 20-F annual report, annual information form and other filings with the U.S Securities and Exchange Commission ("SEC") and Canadian securities regulators, which may be viewed at www.sec.gov and www.sedar.com, respectively. Proposed changes in the mineral law in South Africa if implemented as proposed would have a material adverse effect on the Company's business and potential interest in projects. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Estimates of mineralization and other technical information included herein have been prepared in accordance with NI 43-101. The definitions of proven and probable reserves used in NI 43-101 differ from the definitions in SEC Industry Guide 7. Under SEC Industry Guide 7 standards, mineralization may not be classified as a "reserve" unless the mineralization can be economically and legally extracted or produced at the time the "reserve" determination is made. As a result, the reserves reported by the Company in accordance with NI 43-101 may not qualify as "reserves" under SEC Industry Guide 7. In addition, the terms "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and historically have not been permitted to be used in reports and registration statements filed with the SEC pursuant to SEC Industry Guide 7. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves. In particular, "inferred mineral resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an "inferred mineral resource" will ever be upgraded to a higher category. Disclosure of "contained ounces" in a resource is permitted disclosure under NI 43-101; however, SEC Industry Guide 7 normally only permits issuers to report mineralization that does not constitute "reserves" by SEC Industry Guide 7 standards as in-place tonnage and grade without reference to unit measures. Accordingly, descriptions of the Company's mineral deposits in this press release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of SEC Industry Guide 7.

1 Measured 58.5 million tonnes at 3.42 g/t 4E and Indicated 183.9 million tonnes at 3.37 g/t 4E

2 Proven 48.3 million tonnes at 3.28 g/t 4E and Probable 139.2 million tonnes at 3.22 g/t 4E

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/54271