New Oriental Announces Results for the Third Fiscal Quarter Ended February 29, 2020

PR Newswire

BEIJING, April 21, 2020

Quarterly Net Revenues Increased by 15.9% Year-Over-Year

Quarterly Operating Income Increased by 22.4% Year-Over-Year

Quarterly Net Income Attributable to New Oriental Increased by 41.4% Year-Over-Year

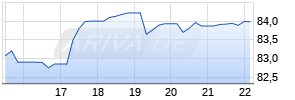

BEIJING, April 21, 2020 /PRNewswire/ -- New Oriental Education & Technology Group Inc. (the "Company" or "New Oriental") (NYSE: EDU), the largest provider of private educational services in China, today announced its unaudited financial results for the third fiscal quarter ended February 29, 2020, which is the third quarter of New Oriental's fiscal year 2020.

Financial Highlights for the Third Fiscal Quarter Ended February 29, 2020

- Total net revenues increased by 15.9% year-over-year to US$923.2 million for the third fiscal quarter of 2020.

- Operating income increased by 22.4% year-over-year to US$117.3 million for the third fiscal quarter of 2020.

- Net income attributable to New Oriental increased by 41.4% year-over-year to US$137.7 million for the third fiscal quarter of 2020.

Key Financial Results

| (in thousands US$, except per ADS(1) data) | 3Q FY2020 | 3Q FY2019 | % of change |

| Net revenues | 923,221 | 796,722 | 15.9% |

| Operating income/ (loss) | 117,253 | 95,780 | 22.4% |

| Non-GAAP operating income/ (loss) (2)(3) | 134,802 | 113,769 | 18.5% |

| Net income/ (loss) attributable to New Oriental | 137,715 | 97,411 | 41.4% |

| Non-GAAP net income attributable to New Oriental (2)(3) | 148,502 | 108,873 | 36.4% |

| Net income/ (loss) per ADS attributable to New Oriental - basic | 0.87 | 0.62 | 41.0% |

| Net income/ (loss) per ADS attributable to New Oriental - diluted | 0.86 | 0.61 | 40.8% |

| Non-GAAP net income per ADS attributable to New Oriental - basic(3)(4) | 0.94 | 0.69 | 36.0% |

| Non-GAAP net income per ADS attributable to New Oriental - diluted(3)(4) | 0.93 | 0.69 | 35.8% |

| | | | |

| (in thousands US$, except per ADS(1) data) | 9M FY2020 | 9M FY2019 | % of change |

| Net revenues | 2,780,209 | 2,253,640 | 23.4% |

| Operating income/ (loss) | 388,748 | 228,562 | 70.1% |

| Non-GAAP operating income/ (loss) (2)(3) | 428,532 | 274,158 | 56.3% |

| Net income/ (loss) attributable to New Oriental | 400,142 | 194,817 | 105.4% |

| Non-GAAP net income attributable to New Oriental (2)(3) | 435,650 | 316,005 | 37.9% |

| Net income/ (loss) per ADS attributable to New Oriental - basic | 2.53 | 1.23 | 105.5% |

| Net income/ (loss) per ADS attributable to New Oriental - diluted | 2.51 | 1.23 | 104.8% |

| Non-GAAP net income per ADS attributable to New Oriental - basic(3)(4) | 2.75 | 1.99 | 37.9% |

| Non-GAAP net income per ADS attributable to New Oriental - diluted(3)(4) | 2.73 | 1.99 | 37.4% |

| | | | |

| | |||

| (1) Each ADS represents one common share. |

| (2) GAAP represents Generally Accepted Accounting Principles in the United States of America. |

| (3) New Oriental provides net income attributable to New Oriental, operating income and net income per ADS attributable |

| (4) The Non-GAAP net income per ADS is computed using Non-GAAP net income and the same number of shares and |

Operating Highlights for the Third Fiscal Quarter Ended February 29, 2020

- Total student enrollments in academic subjects tutoring and test preparation courses increased by 2.3% year-over-year to approximately 1,606,100 for the third fiscal quarter of 2020.

- The total number of schools and learning centers was 1,416 as of February 29, 2020, an increase of 252 compared to 1,164 as of February 28, 2019, and an increase of 112 compared to 1,304 as of November 30, 2019. The total number of schools was 99 as of February 29, 2020.

Michael Yu, New Oriental's Executive Chairman, commented, "Despite the challenges posed by the outbreak of COVID-19 in China, we recorded a top line growth of 15.9%, or 18.7% if measured in Renminbi for the third quarter of fiscal year 2020. The K-12 after-school tutoring business recorded a year-over-year revenue growth of approximately 24%, or 27% if measured in Renminbi. Furthermore, our U-Can middle and high school all-subjects after-school tutoring business grew by approximately 23%, or 26% if measured in Renminbi, while our POP Kids program achieved a growth of approximately 26%, or 29% if measured in Renminbi. From the end of January, we stopped the operation of all learning centers nationwide and effectively moved our offline classes to small size online live broadcasting classes through the self-developed OMO (online merging offline) system, which has played a fundamental role in cushioning the impact on our service and operation. We estimate that the COVID-19 pandemic negatively impacted our top line growth by 8% to 10% for this quarter, as we experienced higher-than-normal refund rates from cancellations and deferments in enrollments for the winter classes from registered students in February. Due to the recent outbreak of COVID-19 pandemics around the globe, we expect the impact on our business as well as the entire education industry in China will last over the coming one to two quarters, especially on overseas related businesses including test preparation and consulting business, which have been unavoidably affected by cancellation of overseas exams, suspension of overseas schools and restrictions on travels. That said, on the other hand, we are also seeing an effective control of the pandemic in China and are pleased to hear the announcement of public school resumption plans which have shed a positive light on our business domestically."

Mr. Yu continued, "Although we are facing the negative impacts from the pandemics for the near term, we remain committed to ensuring the best learning experience and teaching quality to our customers during the challenging time. We remain optimistic of a brighter prospects of our business over the long run. We are confident that with New Oriental's leading brand, superior education product and system and the best teacher resources, we will keep taking market share and continue to be a leader in China's huge after-school tutoring and training market."

Chenggang Zhou, New Oriental's Chief Executive Officer, added, "During the third fiscal quarter, notwithstanding the challenges to daily operations posed by the COVID-19 outbreak, we remained committed to carry out our expansion plan during the quarter and we added a net of 110 learning centers in existing cities and two new training schools in the city of Zhangjiagang and Nanjing. By the end of this quarter, the total square meters of classroom area increased by approximately 30% year-over-year, 11% quarter-over-quarter and 21% comparing with the end of fiscal year 2019. As we expect the industry will undergo a wave of market consolidation once the COVID-19 pandemic fades as certain players may lack financial and digital capabilities to sustain their operations, we believe our fresh offline facilities and strong financial capacity will prepare us to further take market share and strengthen our market-leading position and penetration."

Mr. Zhou continued, "Thanks to our continuous effort in upgrading our OMO system in recent years, we accomplished a prompt migration from offline classroom teaching to online live broadcasting for all customers with online class size the same as offline classes and interactive features highly similar to offline classes. This enabled us to minimize the impact posed by the COVID-19 outbreak and achieve such encouraging results this quarter. We will continue to upgrade our technology platforms and broaden the usage of online tools and content in our OMO system for all business lines throughout the whole network, as well as further develop the best teaching content and courseware to cater to online and offline integrated education method. At the same time, we will provide more advanced training programs to our teachers to enhance their online and offline integrated teaching skills in response to the growing demand."

Stephen Zhihui Yang, New Oriental's Chief Financial Officer, commented, "Due to the negative impact from the COVID-19 pandemic, our gross margin for the quarter was 56.8%, down 80 basis points year-over-year. Our Non-GAAP operating margin for the quarter was 14.6%, up 30 basis points year-over-year, and Non-GAAP net margin for the quarter was 16.1%, up 240 basis points year-over-year. In addition to the direct impact on bottom line from the 8% to 10% shortage of revenue growth, we also incurred some incremental IT cost to support the migration of offline classes to online. In order to minimize the negative impact from the COVID-19 pandemic on our bottom line, we actively adjusted our operational strategy and made more efforts on cost control and reducing expenditures, especially for business lines facing bigger negative impact in the near term. We believe that our continuous efforts will sustain us through the crisis and hopeful that the adverse effects on our business from the pandemic will subside gradually."

Financial Results for the Third Fiscal Quarter Ended February 29, 2020

Net Revenues

For the third fiscal quarter of 2020, New Oriental reported net revenues of US$923.2 million, representing a 15.9% increase year-over-year. Net revenues from educational programs and services for the third fiscal quarter were US$845.7 million, representing a 16.3% increase year-over-year. The growth was mainly driven by increases in student enrollments in academic subjects tutoring and test preparation courses in the recent two quarters.

Mehr Nachrichten zur New Oriental Education & Technology Group Inc. ADR Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.